You can trade many types of assets using a spread bet. however in this ultimate guide to spread betting, I will cover how to use it specifically for stocks, explain the logistics of how it works… and how you can make money with it, in any type of market.

I will also cover the pros and cons, who spread betting might not be for! and detail how I’ve used it for some of my biggest tax-free gains.

Table of Contents

ToggleORIGINS OF SPREAD BETTING.

Research suggests that it was created in the 1940s, by a mathematics teacher turned bookmaker. but, it wasn’t until 1974 that a chap named Stuart Wheeler adopted it for the financial markets. As it was illegal for the British to trade gold directly,

He created an index where people could bet on the movement of gold without actually owning it, using a buy-and-sell price. This was first offered to friends and then opened up to the wider market, it was called the Investors Gold Index.

So the company was born, but the Bank of England didn’t like the name, so it was abbreviated to IG Index, Stuart Wheeler passed away in 2020,

leaving a huge legacy, good or bad? I suppose it depends on what side of the trade you are on.

However, it can be a great weapon in your arsenal! an example of this is, today as I write, on 15th December 2023

A company called Trainline (TRN) has increased in price by 21% at market opening. This is mainly because of an upgraded price target given by Barclays.

In my opinion, it has been overbought, something not unusual in the market, when you add in FOMO and EMOTIONS.

So, I have shorted the stock, by taking out a sell order. This means that instead of following the judgment of the crowd, I am betting that the price will fall, and am currently up around 7%.

If however my judgment is wrong and the price carries on its upward trend, I would simply get out at break even or a small loss, as I have also set a stop loss, (more on this later) which lets me set the maximum amount I would lose!

So not only an opportunity for a large gain but also a strategy to reduce losses.

IG was the first company I used more than 10 years ago, and still the main one today.

HOW SPREAD-BETTING WORKS

Spread-betting can be used as an alternative to buying and owning a stock, Instead of purchasing a set number of shares on an exchange via your broker account and paying the commission.

You would take a buy position via your spread-bet account, there would be no commission, but a cost that is factored into the spread. The other benefit or negative is that it’s a leveraged product,

And you only have to have a percentage of the full cost available in your account. Which is generally around 20-25%.

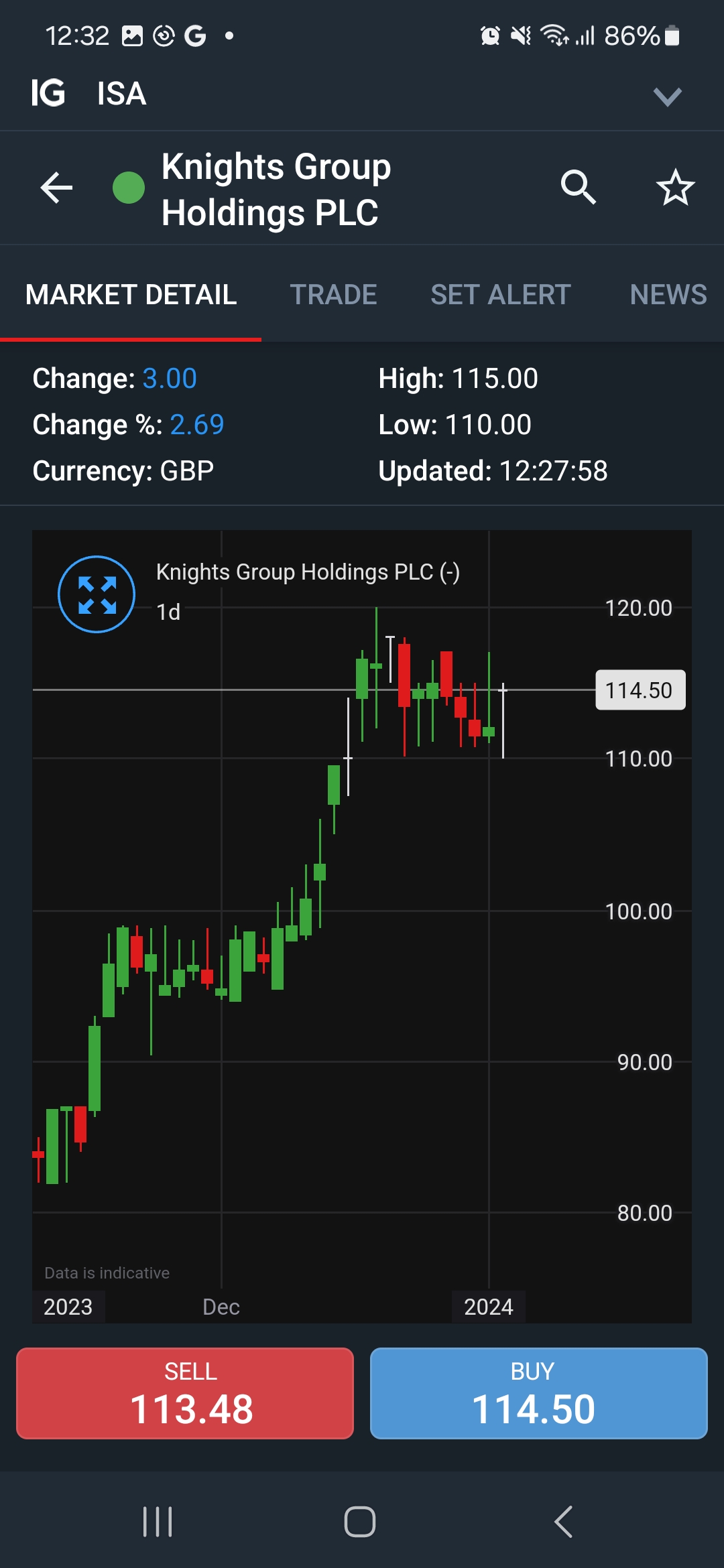

Let’s take a look at a stock I made a good profit on recently called Knights Group (KGH) and compare the spreads and costs If you had bought 100 shares of the stock priced at just over £1.14.

Or £1 a point if bought using a spread bet. The easiest way to convert is by simply removing the two zeros in the number of shares you want to buy, 100 shares equals to £1 a point.

The image below shows the market spread on an exchange.

And, the next image is the stock traded with a daily funded spread bet. (more on this in the next section)

You can see that the spread in the second image is slightly wider, but not far off from the first image. This is because IG adds their own spread in addition to the market.

Are There Other fees?

Yes, when buying on an exchange there will normally be a broker commission, I generally pay around £3 per trade to buy and sell, but there are some commission-free brokers around.

You would also have to pay stamp duty if the stock is listed on the main market.

If buying through a spread bet, there are also fees, depending on the period,

If you know that the intended trade is short term, you may want to use a Daily Funded Bet (DFB), this has a tighter spread but with an overnight holding charge, basically a cost for the margin.

This does get a bit technical, so I would suggest looking it up on the company website and taking the time to understand it, but, it is calculated on the sonia rate, trade per point, the spread, and nights held.

If you aim to hold the trade for longer, it may be cost-effective to use a 3, 6 or 9-month future expiration date, there is no daily charge as it is built into the spread and would have to be rolled over on expiry.

I prefer to use a DFB, and pay the charge as you may decide to get out quick, if the trade moves against you.

The above image details the cost involved buying KGH @ £1 point.

What Is A Stop Loss?

Another benefit of trading with a spread bet is the use of a stop-loss, which is a strategy I would recommend you use on all your trades, it allows you to plan and calculate exactly what you are willing to lose if the trade goes wrong,

successful trading is about cutting your losers and running your winners, and you can have many small losses and a couple of large winners and still be profitable.

As you can see in the image above in the stop distance box, I have set a stop, at 6.7 points… underneath shows the stop distance and potential loss in red. In this case, it’s £6.70.

Imagine that the share price rose by 40% to 158.2, and due to the spread you sold at @156.2, your profit would be £41.3 compared to a loss of £6.7, So, you can see how the above strategy makes sense!

There are two other types of stops you can use, A guaranteed stop and a trailing stop, the first stop guarantees that it will get you out at that price, if say a negative statement about KGH was released when the market was closed,

or a stock you have shorted gets bought out…you would have peace of mind that you would get out at your chosen price, and reduce any heavy losses.

Please keep in mind that everything comes at a cost and you would pay a premium through a wider spread.

A trailing stop is exactly that, it trails behind your trade the exact amount of points you set, If you set your stop 10 points away and Knights Group increased by 20 points,

This would be a great position, as you would almost be guaranteed a profit. If the share price continues its uptrend, great, however, if the price starts to reverse, it will take you out 10 points from the reversal point at a nice profit.

A fantastic strategy and one I’ve used many times!

Spread Betting Strategies.

I don’t want to give away too many strategies here, but the following are a few examples.

Shorting Stocks

The ability to short stocks is one of the many advantages of spread betting, there will always be times when a company may face problems, like falling revenues, large debt, and overvaluations.

Research just as you would to find quality stocks, but flip the fundamentals, this can present some great opportunities.

Trading The Indices.

I don’t trade the indices much as it is gambling, however, sometimes it does make sense, an example would be during the pandemic when major indices around the world collapsed, which then presented a fantastic shorting opportunity.

I made quite a bit, as it just kept falling. There are also times for an opportunity to buy, one of those is the week before Christmas, known as the Christmas rally, for some unknown reason about 80% of time the market rises.

2023 wasn’t as good as previous years, as my raised stop got hit, but still managed 80 points @ £10 point, which paid for a nice portion of my Christmas family holiday.

I recommend trading with tiny amounts, until you build up your trading experience, as getting the timing wrong can have devastating consequences.

Hedging

You can use the same tactics as above, for different reasons, a downturn in the market, may be costly to sell and buy back positions, and providing a hedge reassures you, that your losses will be reduced in the worst-case scenario.

You can also buy an inverse ETF, like Wisdom Trees FTSE 100 3x daily short, which rises three times the percentage the FTSE falls.

Extention Of Your ISA

If you are lucky enough to add the maximum amount to your ISA every year , then lucky you, but be prepared to pay capital gains on anything you have outside of that, The answer… is to trade with your spread betting account.

You pretty much get the same benefits as if you owned the shares, the only difference is how it is funded, be sensible… If you have an extra £10000 to invest, then only buy shares up to that amount,

Don’t be tempted to trade on huge margins.

Who Spread Betting Might Not Be For!

There is a thin line between investing and gambling, especially with spread betting, and if you see yourself as a bit of a gambler, or have a gamblers mentality I would probably leave well alone.

As mentioned, it is a leveraged product and your’e essentially being given access to funds on loan, which can result in over trading,

This can magnify your wins but also result in heavy losses and there are plenty of examples of traders losing life savings.

In Conclusion

If used, correctly it can be used as a great alternative to buying shares, protecting your funds in a meltdown, and utilise shorting opportunities.

If you are considering the use of spread betting…Plan every trade, use stop losses, and be sure not to trade on too much margin.

Good Luck!